An old saying in real estate sales is “your home is worth what someone is willing to buy it for.”

This suggests that there are many different factors, some arbitrary that go into the valuing of a home.

In today’s internet savvy world, many look to industry leader Zillow for information.

But the question is, “Should I Trust Zillow to Determine My House Value in Oklahoma City?”

Short answer: It’s a good starting point but requires more information

We don’t fully trust Zillow for valuing homes and here’s why:

Zillow’s Margin for Error

Zillow has been reported to average anywhere from 18 to 20 percent higher or lower in home estimates. There are even reports of home values on Zillow climbing in declining market areas.

Let’s think about this for a second. For a $200,000 home, a 20 percent deviation is $40,000. That can be a huge difference in pricing.

This margin of error depends on your location and availability. Here’s what Zillow has to say about it:

The Zestimate’s accuracy depends on location and the availability of data in an area. Some areas have more detailed home information available — such as square footage and number of bedrooms or bathrooms — and other areas do not. The more data available, the more accurate the Zestimate value will be.

In the end, this is the starting point of many disagreements homeowners have regarding properly pricing a home.

Simply put: homeowners see the price on Zillow and think that is the starting point for their home. This number might be accurate or it could be way off.

So, How Does Zillow Create Estimates?

Zillow calls its proprietary estimating tool a “Zestimate.” Even with all the pricing factors placed into the formula, there is still a high margin of error because Zillow isn’t actually looking at your home.

The proprietary formula looks at the market pricing in the area. It will factor in the size of the house, the lot, and all features of the home including the number of bedrooms, bathrooms, pools, and highlighted features.

However, even Zillow will say this is a starting point for a true valuation of your home and should not be considered an appraisal or true value.

The reason is the information Zillow uses is reliant on accessing public records and user input such as realtor sales. However, Zillow cannot discern if your home is the dilapidated eyesore in the community or the completely redone and upgraded home everyone is envious of.

Additionally, Zillow doesn’t discern community pockets. These are very common in larger cities where you can have a higher-end community just blocks from a mid or lower-end one.

These “pockets” can skew or be skewed by larger metro data that Zillow factors in that aren’t pertinent.

How We Calculate and You Can, Too

Now, don’t me wrong, we use “Zestimate” as a starting point despite all its flaws.

Yes, as a starting point.

But pricing a home to sell requires a full understanding of the home itself, the location, and current market trends in that area.

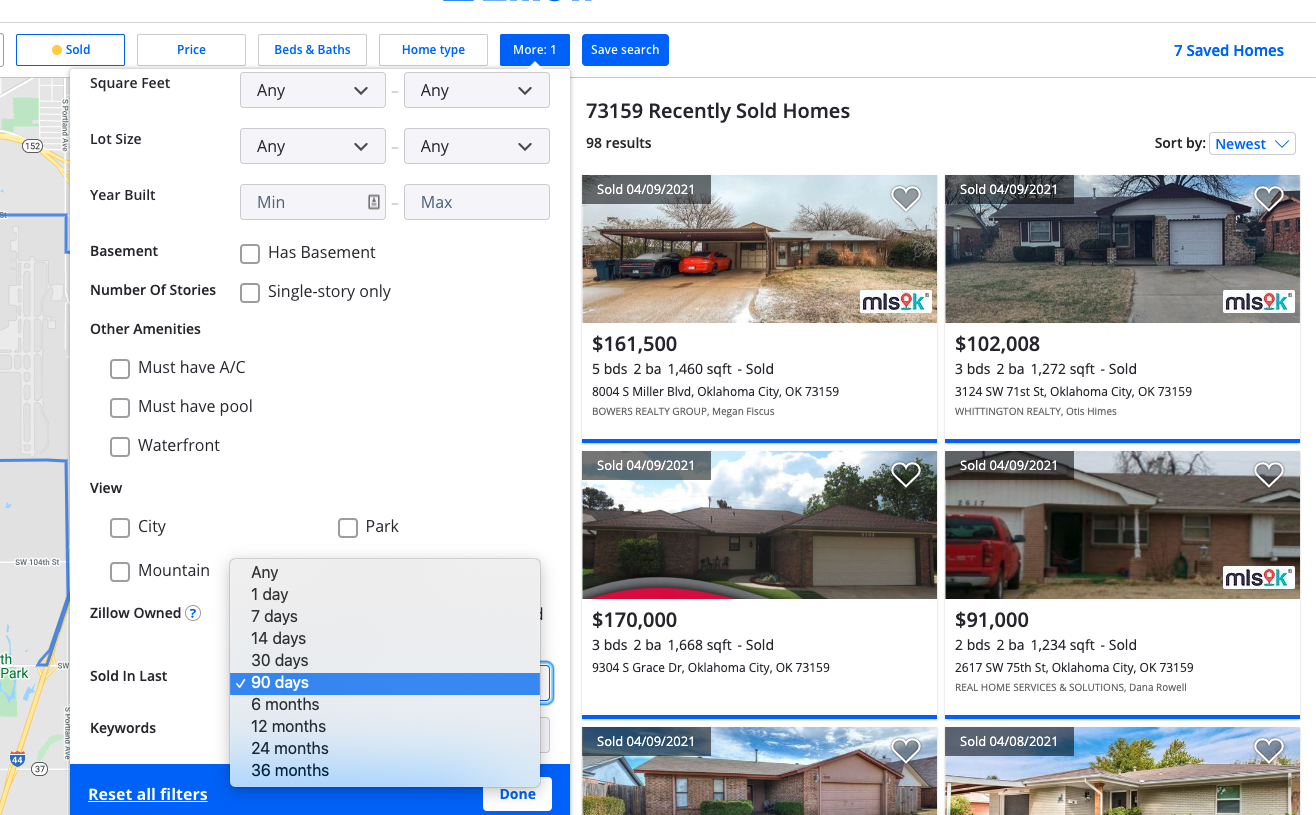

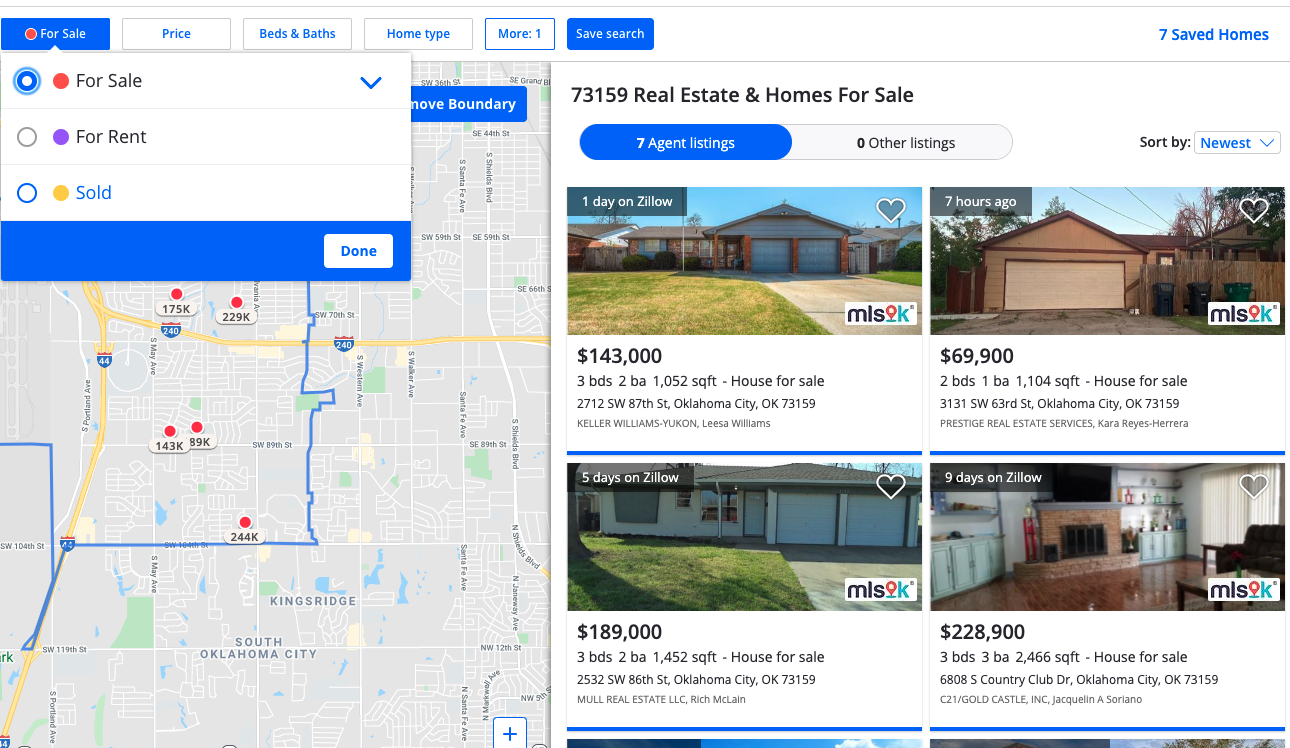

We start off by taking a look at sales in the pertinent area, creating a radius based on your pocket rather than an entire zip code.

Then we will then compare your home based on size, features, and upgrades to those homes that were recently sold, thus appraised, in the previous 3 to 6 months. This range is contingent on how hot the real estate market is in the area.

Then we will then compare this information to existing homes on the market, looking at how your home compares to what else buyers are seeing on the market.

After all, if yours is a well-kept home being sold next to a completely remodeled home, you might not be able to get the same price per square foot at the other.

Additionally, we will consider whether it is a buyer’s or seller’s market.

In a buyer’s market, there are many sellers and not many buyers. In a seller’s market, it’s the opposite – many buyers and not as many sellers. If you’re a seller in a seller’s market, you have the advantage already of having a scarce commodity that buyers want.

If you want to create a frenzy with a lot of eyes on your property in a seller’s market, you can underprice the home and let the bidding begin. This tactic works in many markets including Oklahoma City.

Hope this helps when you start calculating the price of your home.

Need to sell your house fast?

We pay cash for properties in Oklahoma City no matter their condition. Tell us about your property or call Brandon at (405) 300-5817… We never spam or share your info.